Daily Income Calculator

Fill in the yellow box with your desired Daily Income.

The daily income is paid from swap/overnight fees for holding the USDRUB short position.

Interest Rates In Russia

To many westerners, the Ruble and Russia seem fairly unstable and volatile. The currency price does move substantially, and their interest rates create a massive swap differential in the market. While most people will instantly leg it, yelling “Risk, Risk”, some traders will zoom in a little closer to identify the characteristics of this interesting forex pair.

Fortunately, the moves do tend to stay within a range the majority of the time and big swoops happen every now and then. This makes short positions attractive due to the rangebound currency pair and the huge swap. Whilst big moves upward have occurred in the past, this creates an opportunity to get in at an already inflated price in hopes of obtaining a long term short position, holding it for the swap income as a carry trade.

Downward movements create a shift in the trade in a positive manner, while the income trickles in over time as long as you hold the position. Of course, there’s always the risk of hefty moves up in times of instability in the region. This is not one for the faint hearted but in terms of one of the cheapest incomes around, this is where you might find it.

At the time of writing this article, the swap between the USD/RUB is 548 which is much higher than the major’s swaps of around 1 or 2.

This was used earlier in the year where the USD/RUB was higher than it is now, and exited due to a solid move down which was capitalised on. Here’s hoping for a hefty move up to create a nicely positioned entry for this kind of trade to be worthwhile.

There’s an awesome tool which you can set to alert you when a currency or other symbol extends outside of its normal trading range. This can help alert you, then all you have to do is check whether it suits you to enter the trade or not, rather than checking periodically hoping for a price move.

The issue with trading the USD/RUB is that many brokers do not offer the symbol to trade on at present. To access this symbol, head over to this broker and set up an account to gain access to this incredible concept of a trade.

This tool can be used on MT5 and sits in the background monitoring price for you. You can set it up to send a notification to your phone (via MT5 mobile app) and it makes trading this type of thing easy as pie.

If there’s things in this article that don’t make sense or you are new to trading, be sure to check out the basic trading area. If you’re looking for more advanced education, head over to the advanced trading area.

Let’s Talk Money

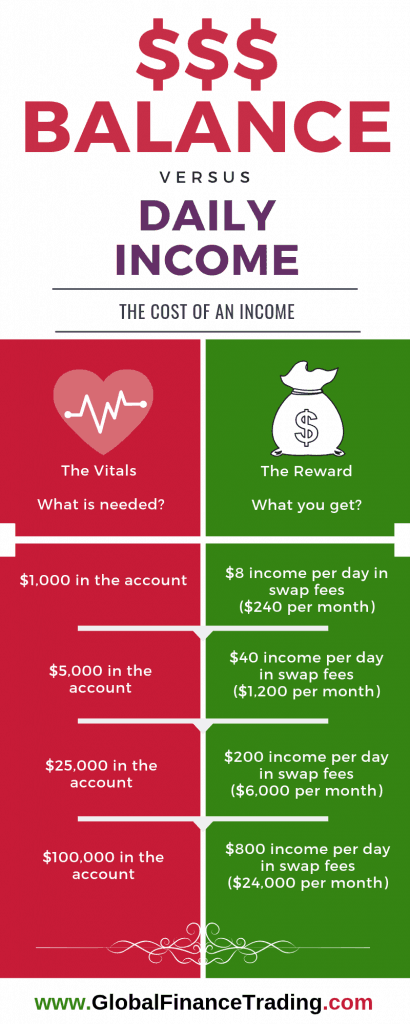

For a real example of what kind of interest this trade pulls in, let’s zoom in on the figures.

This is based on lots traded of 0.01 at the time of the trade being taken. The margin required on an account 1:500 was $2.96 and the daily swap income was $0.12, reflecting around a 4% daily income on the margin requirement. The maximum loss held on the trade was $12 so this is a big jump from the daily income received. The commission was a once off $0.07, the spread is a little wide but it just increases the need for a good entry on this type of a trade.

The account required to hold this position would have been $14.96 ($12 max loss plus the margin requirement) and earning 4% swap per day. Of course it could go even further against you, but this is just a live example of what happened. For those of you with more than $15 in your account, here’s the figures so you can easily multiply the example out:

Margin: $2.96

Movement (Loss): $12

Volume/Lots: 0.01

Daily income: $0.12

Commission: $0.07

Total Account Requirement: $15

Daily return in swap (%): 4%

Now you might be thinking, why would I want to trade for swap if I lose $12.. Fair call, but this was the maximum loss experienced on the trade, and it later moved into profit of around $5 which was closed out with the other trades that were on the USD/RUB.

I have provided a spreadsheet below that you can use to work out your own figures based on this example but please note these numbers are subject to change in the live markets and should not be used to make any investment decision. These things change daily and this is a guide to give an example of situations in the markets where swap is high.

TIP: Change the yellow cell below to your desired daily income to work out the Account Requirement and other information

Let’s say I want $5,000 of income per month. I’ll divide the income required by 30 days (to average out the triple swap to cater for weekends) and that gives me about $167 (daily income required).

The movement experienced on the trade would have been about $16,700, so while the margin is small considering the income, the account would need to be $20,819 to maintain the position.

Commission paid would have been a little over $97 and lots traded would be 13.92. The profit would have been a little over $6,900 if closed, but ideally to receive the income it would be held onto longer, with stops to break even.

To work out $1,000 per month, simply divide the above example by 5.

0 Comments