Prop trading firms have exploded in popularity, offering traders access to significant capital in exchange for proving their skills. But are these firms truly worth it? Are they a game-changer for traders, or just another way to extract fees from hopefuls?

In this guide, we’ll break down the pros and cons of proprietary trading firms, helping you decide whether they are the right path for your trading journey.

What Are Prop Trading Firms?

A proprietary trading firm (prop firm) is a company that provides traders with capital to trade in exchange for a share of the profits. These firms operate on an evaluation system, where traders must pass a challenge or assessment to prove their trading ability before being funded.

Popular prop firms include FTMO, TradeDay, The5ers, TopStep, and Apex Trader Funding, among many others. These firms typically focus on forex, indices, and commodities, with some offering crypto and stock trading.

The Benefits of Trading with a Prop Firm

1. Access to Large Trading Capital

For many traders, the biggest limitation is a lack of capital. Prop firms solve this by allowing traders to manage accounts ranging from $10,000 to $500,000 or more.

2. Low Personal Risk

With a prop firm, you aren’t risking your own capital beyond the challenge fees. If you fail a challenge, you lose only the entry fee rather than a large chunk of personal savings.

3. Profit Splits Can Be Lucrative

Most firms offer profit splits between 70% and 90% in favor of the trader. This means a skilled trader can make significant returns without needing personal investment.

4. No Need for a Huge Trading Account

Building a large personal trading account takes years of disciplined saving and consistent trading. Prop firms allow traders to access large funds immediately after passing an evaluation.

5. Potential for Multiple Funded Accounts

Some firms allow traders to hold multiple accounts or scale their capital, potentially managing millions in trading capital.

The Downsides of Prop Firms

1. Challenge Fees and Recurring Costs

To get funded, traders must pay for an evaluation challenge. Fees vary but typically range from $100 to over $1,000. If a trader fails, they must pay again to retry.

2. Strict Rules and Restrictions

Many firms enforce rules like daily drawdown limits, profit targets, and consistency requirements. A single mistake can disqualify a trader.

3. Payout Delays and Issues

Not all prop firms are reliable. Some firms delay or deny payouts, change their rules suddenly, or shut down without notice, leaving traders without their profits.

4. Emotional Pressure to Perform

Since traders must pass an evaluation before getting funded, many feel added pressure to perform, leading to poor decision-making.

5. Scams and Unregulated Prop Firms

With the rise of prop firms, some companies operate without transparency. Traders must research before joining a firm to avoid potential scams.

Are Prop Firms a Scam?

Not all prop firms are scams, but the industry is unregulated, meaning some firms take advantage of traders. Common red flags include:

- No track record of payouts

- Unrealistic promises (e.g., “Guaranteed funding”)

- Constant rule changes that make passing difficult

- Lack of customer support

Research is key. Always look for firms with a strong reputation, verified trader reviews, and clear, fair policies.

Who Should Consider a Prop Firm?

Prop firms are best suited for:

- Experienced traders who have a proven edge in the markets

- Traders with limited capital who want to leverage larger accounts

- Disciplined traders who can follow strict risk management rules

- Those looking for an alternative to personal funding

If you’re still struggling with consistency, it may be better to refine your strategy before attempting a prop firm challenge.

The Real Deal with Apex Trader Funding

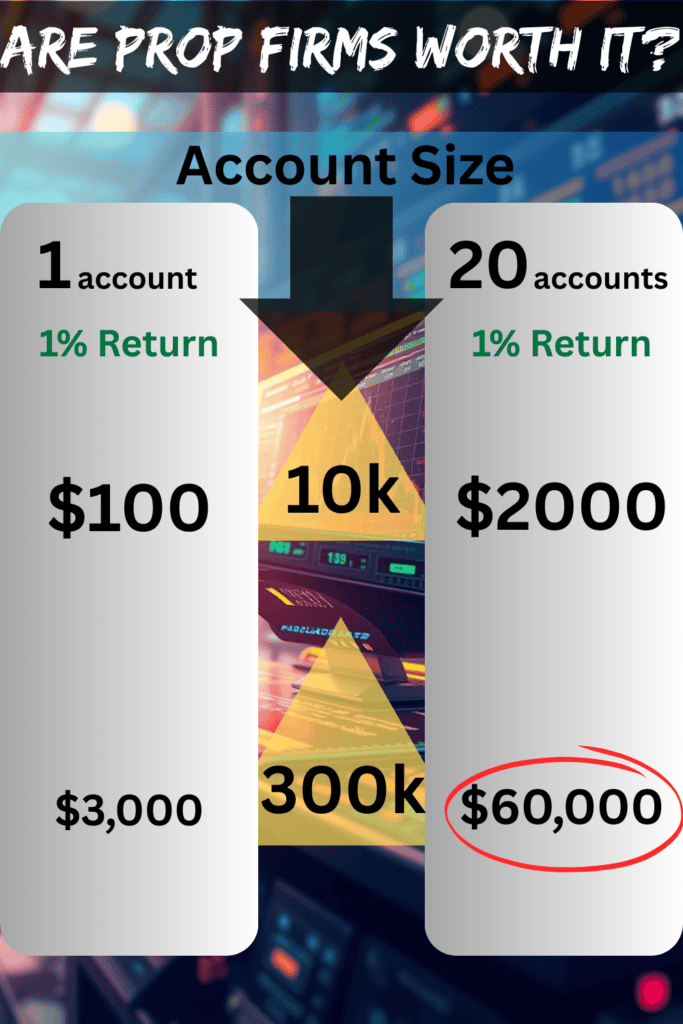

On its own, Apex Trader Funding may seem like any other prop firm. The epic part about this firm is that you can have up to 20 funded accounts at once. So, whatever the account size you go for, let’s work out what the value of a 1% trade might be.

If you have an account of 10k and aim for a 1% return in a month, that’s $100. Multiply that by 20 accounts and that brings it to $2,000 for a 1% return. Less the 10% split to Apex and you’re left with $1,800.

Let’s go harder though, because we aren’t trading for fun, we want to actually make money.

The biggest account Apex offer is $300,000, so a 1% return would be $3,000. Times by 20 accounts and you’re hitting a whopping $60,000 in 1% account movement. Factor in the 10% split to Apex and you’re left with $54,000 in hand. From just 1%. Isn’t that incredible?

While it isn’t easy to get funded and keep your account, would this type of figure hitting your bank be lifechanging? I know it would for many people.

The big goal isn’t something people work towards for a year or two, or even a degree worth of effort of around 4 years. This kind of goal, to be able to replicate an earning of 1% with confidence is something that can take close to a lifetime to master. Go steady, learn what you can and remember your long-term goal.

Final Verdict: Are Prop Firms Worth It?

Prop firms can be worth it if you are a disciplined trader with a solid strategy and can navigate the challenges they present. They offer a fast track to large capital and can be highly profitable for those who can trade within the rules.

However, they are not a shortcut to success. Many traders fail prop firm challenges due to lack of preparation, poor risk management, or emotional trading.

How to Succeed with Prop Firms

- Practice on demo accounts before taking a challenge

- Understand the firm’s rules completely to avoid disqualifications

- Trade with discipline and risk management to stay within limits

- Avoid overtrading and emotional decisions

- Choose a reputable firm with a proven track record

Bottom Line:

For skilled traders, prop firms can be a powerful way to scale up and access capital. But for those unprepared, they can become an endless cycle of challenge fees and frustration. Do your research, trade smart, and only take on a prop firm challenge when you are truly ready.

0 Comments