What is the difference Between OCO and OSO for Tradovate Bracket Orders ATM Strategy? After passing the Apex Trader Funding challenge the requirements state a stop loss must be used.

Rather than placing a stop loss after the trade is entered, I used the ATM strategy to automatically add stops and targets at a predetermined level. But the option came up for OCO and OSO. This article covers the difference between the two and includes use cases for each.

Which Bracket Order is Stop Loss and Target for Tradovate?

The OCO is the ideal stop loss and target setting order type for bracket orders, this is often used as the main ATM strategy from Tradovate DOM or chart. This order type means that when one of the orders is hit, effectively closing the trade, the other corresponding order will be cancelled. This is important, because if the other order wasn’t cancelled, it would stay pending. As the market comes back to the opposing stop or limit order, the trader would be taken into a live trade.

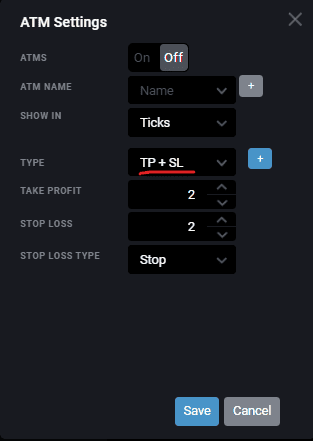

ATMS on or off.

ATM Name to call it something, like if you use this setting on certain futures.

Show in Ticks, Delta Price or $ Value

Choose the values for your TP and SL

and Stop Loss Type.

Stop Loss type includes options of Auto Break Even, Auto Trail, a combo of the two and more.

OCO is the Stop Loss and Take Profit Order Type in Tradovate

Cancelling the other order once hit, the OCO is the chosen setting for stops and targets because it will close the other order once one of them is hit. This could also be used for a single breakout order type where you only want to take the first breakout of a channel.

What is OCO Order on ATM Tradovate?

The OCO order in the ATM settings for Tradovate means One Cancels Other. In other words, if one of the limit/stop orders are hit, it will cancel the other opposing order.

This is great for stop loss and take profit setting.

What is OSO Order on ATM Tradovate?

The OSO order in the ATM settings for Tradovate means Order Sends Order. This means that once an order is hit, it will then send another predetermined order, be it a limit or stop order ready for further trading.

0 Comments