One thing that holds many of us back, is the lack of access to capital. This pushes most of us to use our time in exchange for money to grow our financial position. Using time takes… well, time and a lot of energy to keep at it long term. There are several things that wealth classes have in common with the way they earn their money.

What Makes the Middle Class?

Middle class often earn money through time-based activities, like employment, contracting, freelancing. Couple this with high costs to appear to be ‘doing well’ and you’ve got the long-term middle-class positioning which many strive to get out of. But how can they do break down the barriers and reach the next phase of wealth?

Stepping Up and Breaking Out

Getting out of the middle class is achievable, but what does it mean to ‘be out’ and raise yourself up into upper-class wealth?

Earning your income from capital is a big one. This means using assets to drive your income rather than your time, giving you the ability to make choices, drive outcomes through using capital and ultimately have more freedom over what you do with your time (now that it’s not tied to your earning).

To get capital, we’ve generally got 2 options:

Earn more than we spend and grow capital over time, investing our excess cash.

Access capital from other sources, grow an income producing asset that you own.

Without relying on luck or good fortune, these are the ways you have control over your capital.

This Method Unlocks Both Options

What if you could access capital at a low cost, without effecting your debt score?

Now imagine that capital can be used to buy and sell assets to earn. Wouldn’t that be perfect?

Fortunately, it exists. Not only does it exist, it’s easy to start and there’s no barriers to trying it out.

Interested? Of course you are, let’s go a little deeper.

Unlock Significant Capital

Part one of using capital to earn, is having access to capital. By unlocking significant capital, you have the ability to use meaningful sums of money to use to earn more of it.

Earning from the Capital

When you make a profit with this significant capital, you keep a percentage of it. The best part, it’s a generous slice of the pie where you keep 90% of what you make.

How Does it Work?

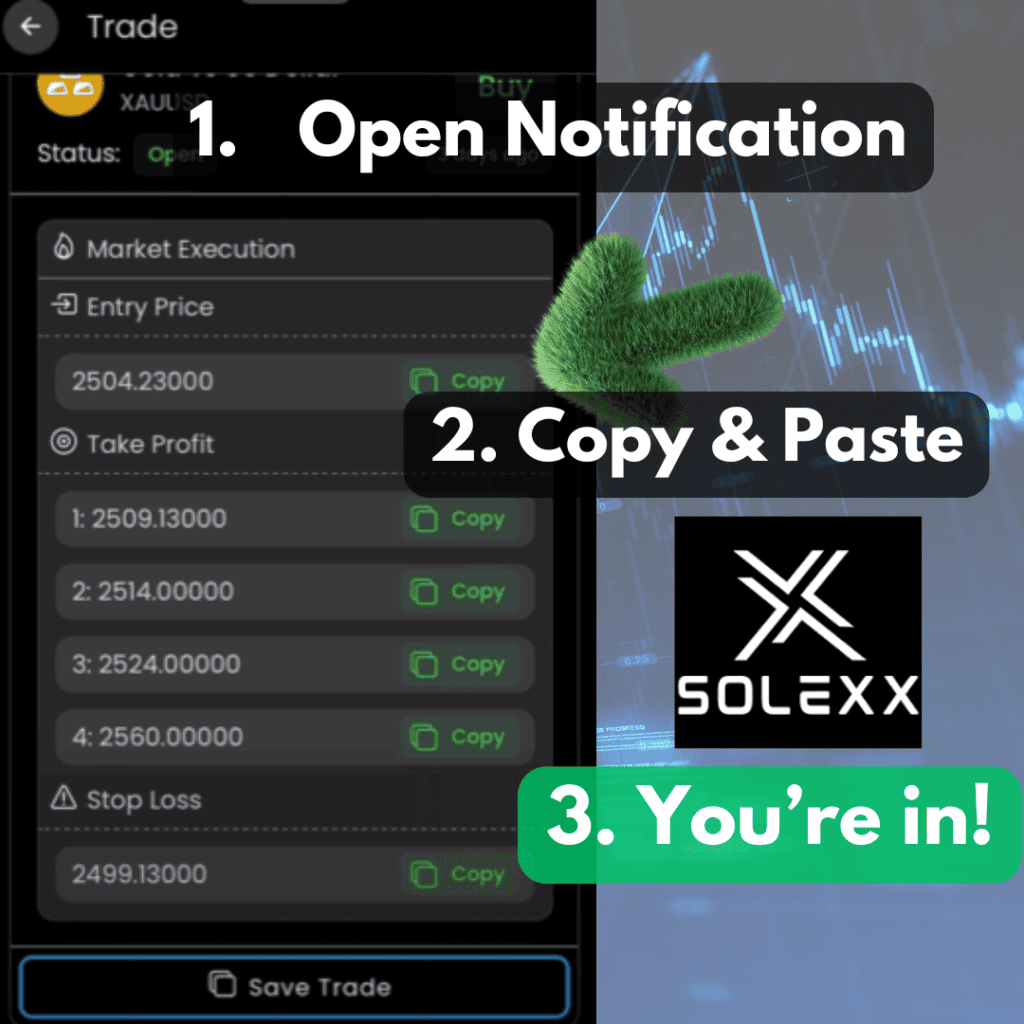

You apply to pass a challenge with a set of rules and if you pass, they fund you.

The challenge is based on buying and selling futures, an asset you can access on your computer, with a price that moves up and down. The idea is to earn a % return without losing too much.

While you don’t earn anything from passing a challenge, it unlocks capital. This major step in shifting wealth class has become far more achievable.

Once you pass the challenge, you get to trade with a funded account of the same value you passed with, keeping 90% of the profit you earn.

How Much Funding Can You Get?

When it comes to getting finance or loans, banks can be notoriously challenging even if you have plenty of serviceable income.

Forget trying to please these institutions who layer red tape over everything to suit the already wealthy. Open the gateway to getting funding based on your ability and effort, not what’s in your bank account to start with.

Here’s what you can access if you pass the challenge (under account size) and here’s what you can get funded with if you do it 20 times. Why 20? It’s the maximum number of accounts you can set up.

| Account Size | Funding with 20 Accounts |

| $ 25,000 | $ 500,000 |

| $ 50,000 | $ 1,000,000 |

| $ 75,000 | $ 1,500,000 |

| $ 100,000 | $ 2,000,000 |

| $ 150,000 | $ 3,000,000 |

| $ 250,000 | $ 5,000,000 |

| $ 300,000 | $ 6,000,000 |

At the top tier, by passing 20 accounts of $300,000 you would unlock 6 million USD!

Even a cool 100k might be enough for a little boost.

We can throw around big numbers till the cows come home, but what does it actually mean for the person buying and selling these assets for a profit?

Bring on the real world scenarios.

Real World Scenarios

To give you an idea of what the outcomes might be if you pass, let’s take a look at how much funding you can get and what sort of earnings you would achieve based on different percentage returns.

Below is a table of the sum of 20 accounts based on the size challenges there are. For example, if you passed 20x 25k accounts you would have $500,000 in funding. The table works up to 20x 300k accounts.

The returns show what your share would be (90% of the total earnings). Good and consistent traders aim to hit 2% or 3% per month on average, some people can make far more in a month however this is generally not sustainable.

| 20 Funded Accounts | 1% Return for the Month | 2% Return for the Month | 3% Return for the Month |

| 500,000 | 4,500 | 9,000 | 13,500 |

| 1,000,000 | 9,000 | 18,000 | 27,000 |

| 1,500,000 | 13,500 | 27,000 | 40,500 |

| 2,000,000 | 18,000 | 36,000 | 54,000 |

| 3,000,000 | 27,000 | 54,000 | 81,000 |

| 5,000,000 | 45,000 | 90,000 | 135,000 |

| 6,000,000 | 54,000 | 108,000 | 162,000 |

Single Funded Account Earnings

For those looking for more of a dabble and explore how it all works, here’s a table with single funded account returns based on 1, 2 and 3% for the month, less 10% due to the profit split where you receive the 90% portion of what you make.

| Account Size | 1% Return for the Month | 2% Return for the Month | 3% Return for the Month |

| 25,000 | 225 | 450 | 675 |

| 50,000 | 450 | 900 | 1,350 |

| 75,000 | 675 | 1,350 | 2,025 |

| 100,000 | 900 | 1,800 | 2,700 |

| 150,000 | 1,350 | 2,700 | 4,050 |

| 250,000 | 2,250 | 4,500 | 6,750 |

| 300,000 | 2,700 | 5,400 | 8,100 |

How Much Funding Would You Want?

This is a funding calculator to help plan how much funding you would want to hit your goals. Enter you desired monthly income and then your expected return from trading, and it will show you the capital needed to hit that return on a 90% split with the firm.

Funding Calculator

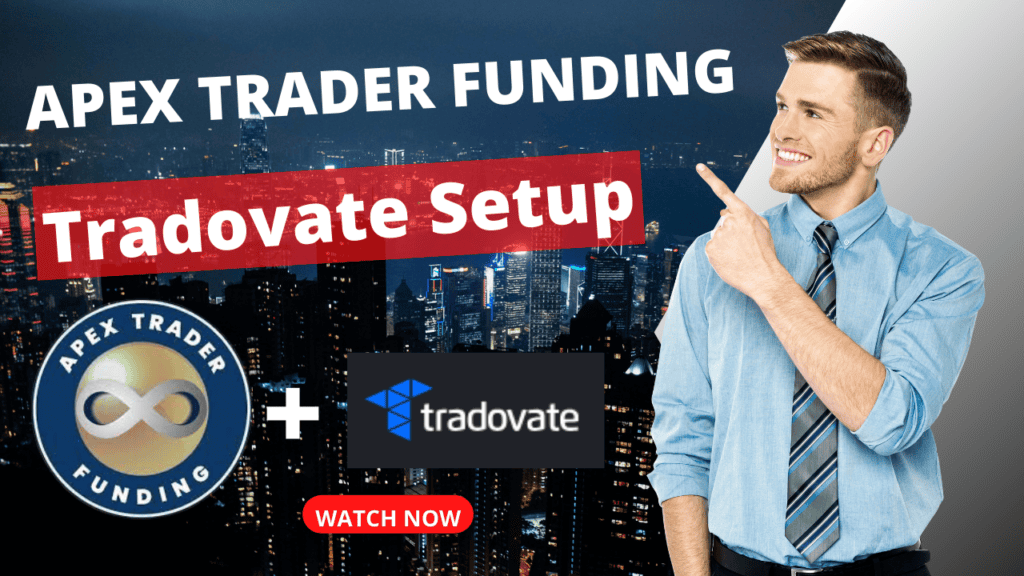

How to Apply and Set Up?

Applying is easy, there’s no stringent rules and hassles to get accepted. All you do is choose a challenge account you want to go for. There’s a good video comparing the accounts in terms of value.

Setting up is a little more effort, you basically log into a trading platform on your web browser and you can start trading. Here’s a Full Tradovate Guide on setting up your account and getting started for beginners.

Tip for Beginners: Using a Tradovate account is much easier to set up and get into.

0 Comments