Looking for a Forex Pattern Trading Tool to make life easier? This article dives into how and why trading patterns work, along with the pros and cons and how to overcome the struggles traders face when trying to trade with patterns in forex and index markets.

Benefits of Pattern Trading - Why Trade Patterns?

Patterns hold underlying supply and demand information

Patterns help to indicate opportunistic price points to trade from

Patterns can help add weight to your own analysis and trading style, creating an additional layer of certainty.

Reasons Why People Don’t Trade Patterns

Learning the patterns types can be hard

Applying these patterns to live markets can be a challenge.

They can take time to find

Viewing multiple markets and timeframes can be overwhelming for traders. Here’s what people have to say about the manara tool and Eaconomy in general.

All of these drawbacks are solved in this article.

Do Trading Patterns Work?

Patterns highlight a range of information in the pricing of the asset. From psychological levels through to strong representation of supply and demand, patterns show far more than a simple visual template.

Supply and Demand of Trading Patterns

Buyers or sellers build up in certain areas, creating price shifts or turnarounds at certain areas. As prices move and react over a series of these reactions, or patterns, the expected result based on the underlying supply and demand is building up.

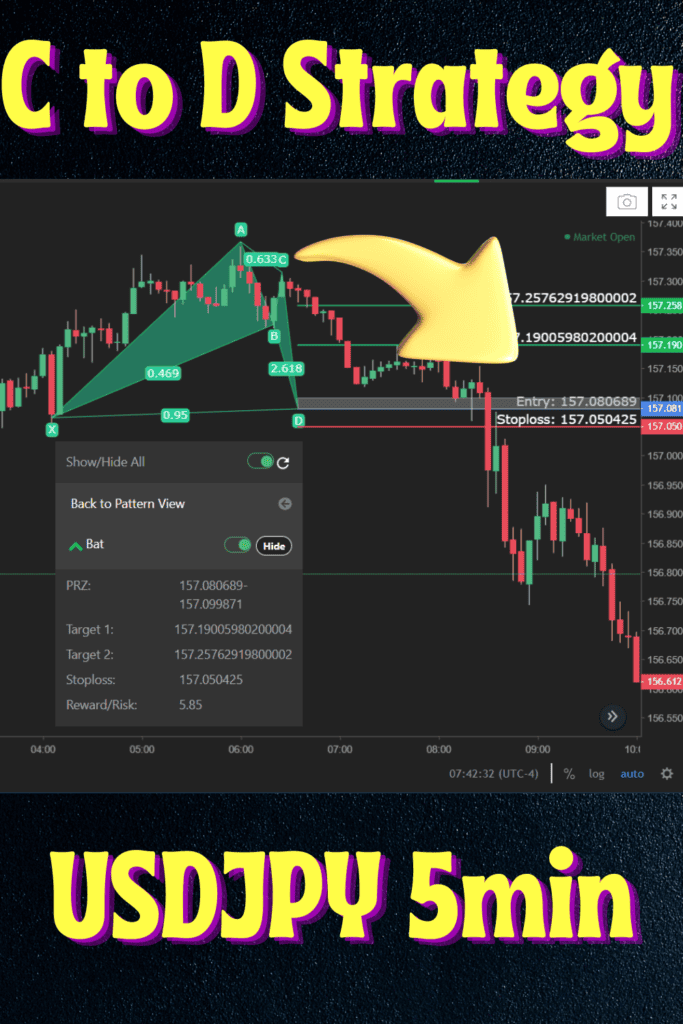

This underlying supply and demand creates expected shifts in price in the market over a series of legs, often denoted as A through to C or D. As the pattern confirms each leg, the probabilities and expectations often increase.

Pattern Trading Confirmed by Reddit

Generally the place where many things are shot down, this is one of the few trading reddit’s that found support from most redditers on the topic. While this is not proof by any means, it gives a good perspective of what people are actually using and happy with. This same community does highlight the silliness of buying indicators that never lose (because that doesn’t exist).

Why Doesn’t Everyone Use Patterns to Trade With?

Patterns are sometimes difficult to observe and watching a range of markets to determine if a pattern has set up or not could be a massive challenge. These patterns don’t always show up easily and it would require a large amount of focus to determine if a pattern fits one of the many pattern setups out there.

Pattern Types

There are many pattern setups, including crab, double top, bat, Gartley and much more. Each pattern type has an expected layout of points from A through to D, with each point representing a turning point in the pattern’s layout.

Identifying a Pattern

To learn these patterns could take some serious effort, then to identify them on a live chart would be even more challenging. This is because the markets don’t always follow an exact layout, but rather, general layouts and extensions from the turning point.

How to Trade a Pattern

Let’s say you know what to look for, now you have to find it in the live market. Normally this would require the trader to keep an eye on multiple markets (since waiting for a single market to set up would take a long time, with one Redditer saying it would take too long to wait for patterns).

It’s one thing to find a pattern, but then you have to trade it. Waiting for it to set up can be time consuming and encourage early trades which is a risky trait. The best trades are the ones you wait for professionally and in line with the plan.

There’s a couple of ways people trade these patterns. One is the final leg after the D point is hit, or trade the incomplete pattern from the expected C to D points.

As always, the key is risk management including your position sizing and stop loss.

There’s got to be a better way to find these patterns, right?

How Pattern Trading can Give an Edge in the Market

Patterns are formations in the market that depict areas of supply and demand, the core driver of price.

Pattern trading gives traders an edge by offering key levels to work around, potential targets and likely areas where price will once again reach.

That means that traders can hold more confidence in their trade direction, areas of stops and targets and layer on their own strategy and trade plan, within, and in line with, the pattern criteria.

Making Pattern Trading Easier

Rather than constantly reviewing tons of charts and timeframes to find a pattern, there is an easier way.

Picture this, every time a pattern sets up, you get a notification when it’s time to start trading it.

When you click that notification, it takes you to the live chart and you see the overlay of the pattern so far, along with the anticipated movements based on the underlying supply and demand.

These patterns will develop in the market all the time across multiple markets and multiple time frames and you can simply open up the alerts and trade them as you please.

To get notifications and the chart pattern overlays on a live feed, you need the Manara Pattern Tool from Eaconomy.

0 Comments