Trading the Germany stock index market requires the Eurex market data subscription to enable the ability to trade the FDAX micro, mini and full contracts for Apex Trader Funding prop firm. This guide shows you how to get the Eurex on Tradovate so you can trade the GER40 equivalent CFD product – the FDAX futures.

A quick note that you can’t trade the FDAX on Rithmic at the time of writing this article, so be careful when selecting your trading platform. If you want the Dax, you need the Eurex on Tradovate.

Eurex on Tradovate – Get the Market Data Subscription

Open the Settings on Tradovate

In Tradovate, go to the Application Settings as per the screenshot below. You’ll need to be logged in to see this. Then go to Subscriptions tab up the top.

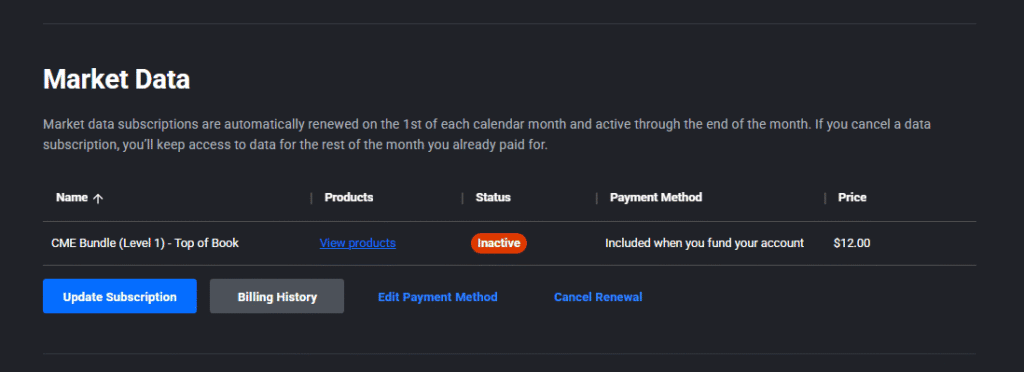

Market Data to Get DAX on Tradovate

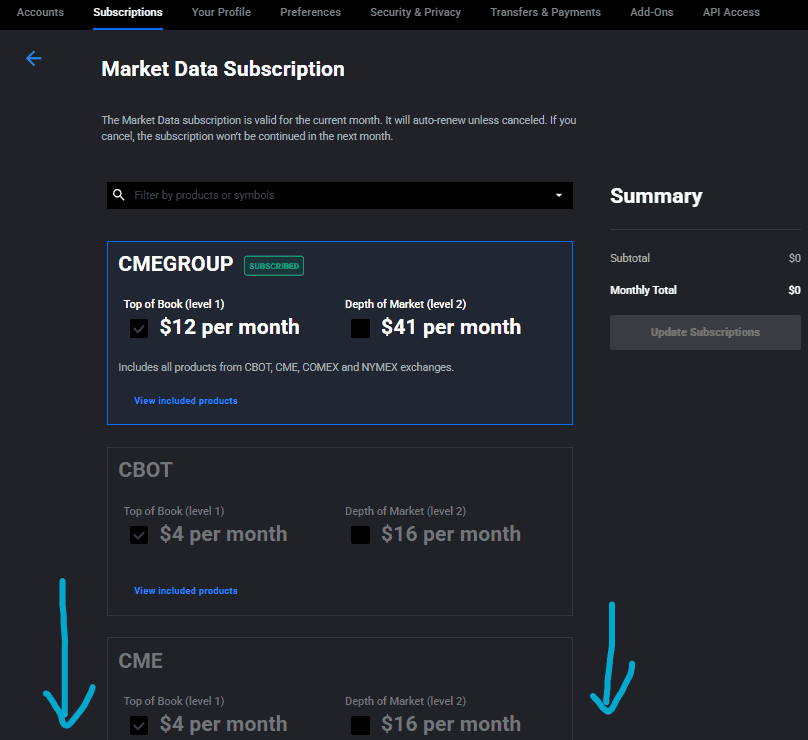

Under the Market Data heading, you should see an Update Subscription button like in the screenshot below, click that. It will open up the subscription packs you can subscribe to for additional data. This is where you can add the Eurex on Tradovate, so hang in there.

Scroll down until you see the Eurex subscription, tick the box and update subscription. On my platform, it shows as $24 a month for level 2 data which includes the FDAX German Futures index market which is similar to CFD contracts like GER40 and GER30 or DE40 etc. The Update Subscription button should turn blue or highlight once there has been a change made.

This subscription does come at an extra cost so you’ll need to process a payment to add it on.

Eurex on Tradovate Plus Free Addons

Once you’ve got the Eurex market data subscription for Tradovate, you’ll need to add some Add Ons to get Order Flow like I show in my live trading sessions on Youtube. Head to Add Ons tab in the settings, then activate OrderFlow+ and Free Indicators. These are both at no extra cost on my platform, but again, some countries have different costs and settings based on Tradovate’s requirements.

Haven’t got your Apex Account yet or you’d like a discount? Get yours now and get at least a 50% discount (or the highest on offer at the time you join) with this Apex discount link.

If you are in need of a full beginner’s guide on setting up Tradovate for Apex Trader Funding this guide will help you get set up in a step by step video tutorial.

One of the biggest downsides to Apex Trader Funding evaluation rules, is the instant trailing drawdown rather than the End of Day trailing drawdown like TradeDay offer. For a bit more cost, the chances of passing may be far greater due to the way you can let trades run with a little less stress. It gives you the option of which drawdown type to choose now, so be sure to check the drawdown account type before buying.

When it comes to reading order flow, I certainly needed a guidebook to wrap my head around how the bid and ask orders effected the market and who ultimately had control. It’s not as simple as ask is a buyer and bidders are selling. Limit orders flip the concept, so Trader Dale’s Order Flow book is an essential read.

For those of you big hitters out there, I’ve also done a guide for setting up a VPS and running a trade copier across the multiple accounts, up to 20 accounts with Apex Trader Funding. This story about one man’s last go at freedom shares the capacity of funding that Apex has to offer.

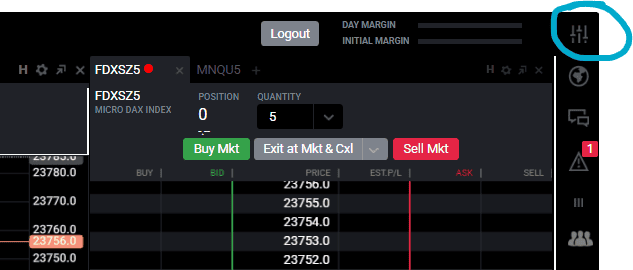

The Eurex on Tradovate gives access to the FDAX, where contracts are massive for a 25k account, so be careful when you choose which futures contract you are going to use. Here’s the contracts for your reference:

FDAX – full contracts.

FDXM – mini Dax contracts where one contract is about $5 a point.

FDXS – micro Dax index ends up being around $1 per point.

These contracts are enabled when you have the Eurex on Tradovate. I find it helpful to watch each of the order flows on the full and mini to get a feel for who has control across the total market.