If you’re watching the global markets this year you’re probably seeing headlines about funded trader programs, new capital‑access models, and how they’re influencing everything from forex pairs to index moves. At the heart of this shift is prop firm trading, a concept that once sat on the fringes of retail finance but is now stepping into the spotlight. In this article we’ll unpack how prop firm trading is evolving, what that means for forex and index markets, and why lifestyle‑oriented traders are paying attention.

What is Prop Firm Trading?

Prop firm trading refers to the practice where a trader receives capital from a proprietary (“prop”) trading firm in exchange for following certain rules, profit‑sharing and risk limits. These firms have grown rapidly in recent years as an alternative vehicle for traders who want to work with significant capital without putting up their own funds.

In the past prop firms were mainly associated with equities or futures desks, but increasingly you’ll see prop firm trading models applied to forex, indices, and multi‑asset markets thanks to technology and remote trading platforms.

Why Prop Firm Trading Is Having A Moment

There are several high‑impact reasons this concept is gaining traction:

1. Surge in demand and search interest

Industry data shows global search volume for prop firm trading has surged by hundreds of percent in recent years. BestPropFirms This signals rising awareness among retail traders that access to firm capital is no longer restricted to hedge funds or institutions.

2. Access to larger capital and diverse markets

With prop firm trading, both forex and index markets become more accessible. A trader may be able to access funding and trade a broad range of instruments including major indices like the S&P 500 or FTSE, and currency pairs, without having to supply all the capital themselves.

3. Technology, festivals and lifestyle‑upgrade appeal

Lifestyle‑oriented traders see prop firm trading as a route to live the “full‑time trader” dream: remote setups, flexible hours, and a sense of being connected to global markets rather than 9‑to‑5 desks. This has an aspirational appeal that feeds the growth of prop firm trading.

The Ripple Effect On Forex & Index Markets (H2)

As more traders enter the space of prop firm trading, the effect on forex and index markets can become interesting, without implying any guarantee of performance.

Forex implications

Since many prop firm programs allow trading of major currency pairs under professional‑style conditions, what you’re seeing more often is a greater number of traders applying disciplined strategies to FX markets. That may translate into tighter spreads, quicker reaction to economic data, and perhaps more frequent participation in cross‑pair flows.

Index market implications

When prop firm trading enters index markets, such as major stock indices or index futures, the influx of capital‑backed traders can lead to higher volumes around breakout zones, increased volatility near economic events, and the potential for more traders reacting as a group. Some firms emphasise indices as part of their multi‑asset access.

Consideration of risk rules and loss limits

One of the hidden levers here is that prop firms impose firm risk limits (drawdowns, maximum loss per day, etc). When many traders adhere to similar rules, it could create clustering of activity at certain price levels — something the lifestyle‑minded trader might watch, though not base decisions on.

What Lifestyle‑Oriented Traders Should Note

If your view is that trading should support a lifestyle of mobility, flexibility and markets‑awareness, here are four things to keep in mind around prop firm trading (without suggesting you act on them).

A. Know the challenge and rules

Many prop firm trading programs require passing a “challenge” phase or evaluation. Understanding the rules, drawdowns, permitted instrument types, and verification steps is part of the game.

B. Habits matter over hype

The transition from challenge to funded status often rewards discipline, consistency and risk control rather than short bursts of “big wins”. For a lifestyle‑trader that means focusing on routines, mindset and process.

C. Market access matters

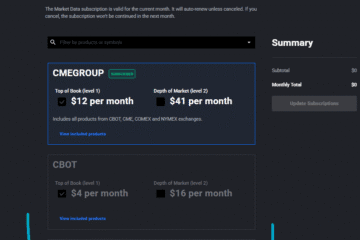

If you plan to trade both forex and indices, confirm that the prop firm trading model you’re diving into offers both asset‑classes. Multi‑asset access is increasingly common.

D. Liquidity and event‑flow awareness

As traders gain firm capital and trade actively in index and forex markets, the importance of liquidity around economic events becomes more pronounced. Lifestyle‑oriented traders who travel or maintain part‑time routines should ensure they’re comfortable trading in variable market conditions.

The Big Take‑away

In 2025 prop firm trading is no longer a niche side‑show. It’s influencing how forex and index market participants, especially those working remote, flexible and lifestyle‑driven setups, engage with global markets. For traders who prioritise flexibility and access, the model offers a different route into major markets. For market watchers it means one more wave of well‑capitalised participants applying rules, discipline and strategy to areas once occupied solely by full‑time professionals.

Final Thoughts

It’s clear that prop firm trading is reshaping parts of the trading ecosystem. If you’re engaged in forex or index markets, the rising presence of funded traders, multi‑asset access and technology‑driven platforms is something worth tracking. It might not change your strategy overnight, but it could influence the context in which your trades play out.

To stay updated with the latest, and to catch our links for the DAX sessions, be sure to join our Telegram channel or Facebook page.